We just started a New Year and many recipients of the VA Pension with Aid and Attendance will lose their benefits this year. Why? Because of a letter VA applicants receive after they have been approved for benefits. The first letter, issued in January 2013, contained the news, originally given in a VA press release on December 20, 2012, that the annual Eligibility Verification Report (EVR) was no longer a requirement. For individuals who had experienced the “old” EVR process, this was quite exciting.

Why the excitement? The EVR was the yearly submission by the Veteran to update the VA with current income and medical expenses. It is a tedious task, both for our clients who had to keep records of all medical expenses and for law firms who cannot charge for these additional services. Foregoing this task saves time and stress.

Why the excitement? The EVR was the yearly submission by the Veteran to update the VA with current income and medical expenses. It is a tedious task, both for our clients who had to keep records of all medical expenses and for law firms who cannot charge for these additional services. Foregoing this task saves time and stress.

Why did the VA discontinue the practice? According to the press release, the VA stated that the change allowed them to:

(1) Reallocate the staff who had processed the EVRs to instead tackle the compensation claim backlog, and

(2) The VA could now obtain current income information directly from Social Security and the Internal Revenue Service.

This sounds like a beautiful plan. However, in the absence of updated unreimbursed medical expenses (UME), which is what reduces the “countable income” to meet VA eligibility criteria, the VA will continue to use the last reported medical expenses when reviewing eligibility for ongoing years. This means that for any VA beneficiary whose medical expenses are just high enough to offset their income at the time of application, may have benefits terminated with future increases in income (cost of living adjustment increases, etc.). Therefore, while the VA says that it does not require annual reviews, it is important to meet with your VA benefits clients to assess changes in income and medical expenses that could impact receipt of VA benefits. The best time to meet is after the tax deadline of April 15 when it can be expected that your clients have gathered the prior year’s medical expenses in order to file their tax returns.

Use VA form 21P-8416 when updating medical expenses for the VA. The VA will consider UMEs submitted through December 31st of the following year for the prior year’s “eligibility period” in which the UME was paid. For example, you have until December 31, 2015 to submit UMEs incurred and paid for during the calendar year 2014. It is not necessary to provide receipts of those medical expenses as long as the VA Form 21P-8416 clearly identifies the nature of the expense, the provider, the date, and for whom the expense was paid. Along with the 21P-8416 for actual unreimbursed medical expenses for the prior year (i.e. 2014), it is also recommended to complete an additional VA Form 21P-8416 with “projected” UMEs for the current year (i.e. 2015). These are both filed with VA Form 21-4138, Statement in Support of Claim, requesting that the VA consider these medical expenses. This should be submitted to the pension management center where you file your pension claims. You will generally only get a response from the VA to this submission when it requires a change in the monthly VA benefit; otherwise, the only indication that the submission has been received, considered and accepted is the continuation of the claimant’s monthly benefit.

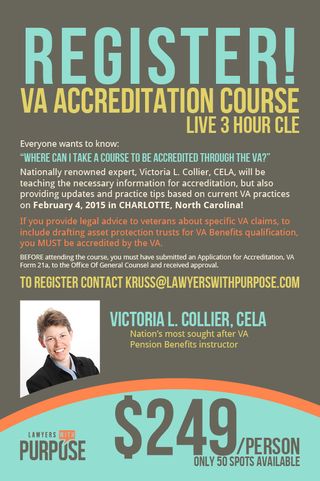

Victoria L. Collier, CELA, Elder Care Attorney, Co-Founder of Lawyers for Wartime Veterans and Lawyers with Purpose, Veteran, author of 47 Secret Veterans Benefits for Seniors and most recent book, Paying for Long Term Care: Financial Help for Wartime Veterans: The VA Aid & Attendance Benefit.

If you're interested in learing more from Victoria L. Collier, join us in Charlotte, NC, February 4th, where she will be LIVE in the room offering VA Accreditation. We only have a FEW SPOTS left so register NOW with Kyle Russ at kruss@lawyerswithpurpose.com.