Today is Day 3 of the Lawyers With Purpose Members Tri-Annual Retreat. We have the priviledge of guest speaker Christine Kane speaking and we want to share with you a little sneak peek of her agenda for the day.

It actually shows very little of what's actually going to happen in the room. Estate Planning Attorneys nationally, together with their teams talking about growing personally and professionally. Transforming themselves and their team. It's just a little peek of the agenda from 10-2:30 but they've all been together for almost 3 full days!

It actually shows very little of what's actually going to happen in the room. Estate Planning Attorneys nationally, together with their teams talking about growing personally and professionally. Transforming themselves and their team. It's just a little peek of the agenda from 10-2:30 but they've all been together for almost 3 full days!

- Why do we set goals? Why don't we achieve them? Limiting beliefs, etc.

- Breaking limiting patterns

- Aspiration (motivation/goal/dream)

- Awareness

- Action (mindset and energy included)

- You can’t run away from yourself!

- What’s in the way of your goals?

- Exercise

- Set your goal – pick your number $ for the year or 3 years

- Describe your environment – 3 words

- Describe your time – 5 core activities you spend bulk of time doing

- Doing things outside of what you’re being called to do costs energy

- The more you start doing things you’re good at, the more money you’ll make (hiring people to take the chores off you)

- Partner up, share your vision.

- Name the vision

- Camp Scarcity (fear): not enough, loss, competition, limits, well is dry, constriction/contraction, not deserving, hard, cold, alone, isolated, familiar, struggle, envy, martyr, victim, guilt, judgment, perfectionism, greed, lust, experiences deplete us

- Planet Abundance: in the flow, effortless, ease, clarity, creative, innovative, community, collaboration, gratitude, love, appreciation, joy, happiness, presence, compassion

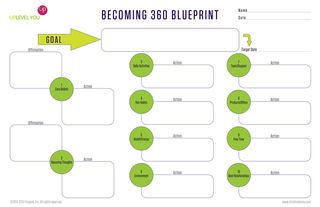

- Worksheet prep (Becoming 360)

- 10 areas of work and life, in terms of your dream

- 5 core beliefs of the person you want to become

- Rate truth – never, fairly, sometimes, always

- Partner, share your 5 beliefs and rating

- Create one affirmation statement for one of these beliefs

- Create one action step that locks in the affirmation

- Recurring thoughts, positive and negative

- Write 5 beneficial recurring thoughts in journal

- Rate truth – never, fairly, sometimes, always

- Partner, share the beliefs and rating

- Create one action step for these recurring thoughts

- Worksheet

- Fill in sections 1-2, “Becoming 360”

- Daily activities (present)

- WWOD – What Would Oprah Do?

- Are your daily activities in line with the vision you? What can you offload?

- Cross off anything on list that your vision self would no longer do

- Start small if you need to, major drains

- There is no recipe or formula, it’s your own experience

- Protect your confidence, cross off anything negative

- Partner up, share list and what’s going away

- Create one action step for worksheet

- Tell Me Later and Text Minder – apps for future reminders

- Task Rabbit or Angie’s List to find help

- Habits

- Recurring patterns vs. activities

- Partner; share new habit you will implement for next 90 days to bring this vision

- Health & Energy

- Holistic model, don’t compartmentalize – business and health are interrelated

- 3-5 places in health (mental, mindset, physical, etc.) that are draining you

- Action step: 1 thing you can do to begin process of healing what’s draining you. Something do-able. Set the intention to see what can open up – be open to miracles.

- Partner, share your action.

- Environment

- What can you clean up?

- Partner and share who you’ll have on your team

- Products & Offers

- What needs to change to get you to your income goal?

- Books leading into program (create back-end first)

- 3 things your vision self offers, and how they’re priced

- Stand and partner, share

- Free Time

- Schedule your time

- How often does your vision self take vacation?

- What does free time look like?

- Partner – current free time, one action step to boost it this year

- Best Relationships

- 5 common, important traits of the people your vision self most spends time with

- 5 people you currently hang out with the most

- How do these 5 people measure up to the 5 vision traits? Do these people serve you?

- Action step to build better, more supportive relationships

You don't want to miss Pheonix in October. Block October 22nd – 24th on your calendar now and join in the conversation if you weren't able to make it this time. I can't wait to hop on my implementation calls next week and hear what the members came up with for their firm Money Plan and Becoming 360!

Roslyn Drotar – Coaching, Consulting & Implementation, Lawyers With Purpose