I don’t think anyone really expected a great announcement from the VA on March 25, 2015, with the end of the 60-day public comment period on the proposed VA rule, RIN 2900-AO73, regarding net worth, asset transfers, and income exclusions for needs-based benefits. However on that day the VA did announce several changes effective March 24, 2015 that directly impact all claims. One of these changes was the amendment of the adjudication manual M21-1MR to introduce a new intent to file procedure which replaces the informal claim process to lock in an effective date for an Improved Pension claim (with aid and attendance) prior to the filing of the Fully Developed Claim.

The VA web page http://explore.va.gov/intent-to-file, as well as the March 2015 Fact sheet issued by the VA, explain that there are currently three ways to declare an intent to file a claim:

- Electronically via eBenefits.

- Completing and mailing the paper VA Form 21-0966, Intent to File a Claim for Compensation and/or Pension, or Survivors Pension and/or DIC.

- Over the phone to the VA National Call Center or in person at a VA regional office.

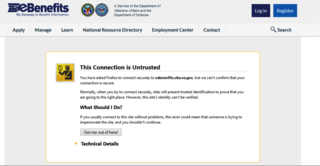

eBenefits is accessed from the VA website via this page https://www.ebenefits.va.gov/ebenefits/apply, However the link for filing pension claims currently generates an error. The content is blocked in both Internet Explorer and Mozilla Firefox web browsers as an untrusted connection.

eBenefits is accessed from the VA website via this page https://www.ebenefits.va.gov/ebenefits/apply, However the link for filing pension claims currently generates an error. The content is blocked in both Internet Explorer and Mozilla Firefox web browsers as an untrusted connection.

If you prefer to continue using a paper form to lock in an effective date, you are now required to use the VA form 21-0966. What happens if you filed an informal claim on or after March 24, 2015? Pursuant to M21-1MR, Part III, Subpart ii, Chapter 2, Section D, 2b, “Consider a request for benefits not filed on an appropriate prescribed form on or after March 24, 2015 a request for application.” The VA will respond to a request for application by sending correspondence that instructs the claimant which forms are needed to formalize the claim. Nevertheless no effective date will be locked in until a complete intent to file or a completed application is submitted. There is no recourse if the VA rejects an informal claim filed on or after March 24, 2015 as the final rule of 38 CFR Parts 3, 19, and 20 RIN 2900–AO81 “also eliminate the provisions of 38 CFR 3.157 which allowed various documents other than claims forms to constitute claims.”

The option of declaring an intent to file by telephone or in person at the VA regional office has the disadvantage of lack of documentation. Furthermore the average waiting time for calls to the VA National Call Center to be answered is over an hour and, thus, would not be an efficient use of your time to use this option. Thus for now if your firm chooses to lock in an effective date prior to the filing of the fully developed claim, you must use the second of the three options listed above. Our firm has changed our process to start using the form 21-0996 with all future VA claims. The new form will also be included in a future update of the Lawyers With Purpose software.

The easiest way to receive important notices directly from the VA is to subscribe to the email delivery of VA News Releases at https://public.govdelivery.com/accounts/USVA/subscriber/new or visit their website at www.va.gov.

There is still time to grab a seat for our 3.5 day Practice With Purpose Program in St. Louis next week! We'll be talking about Asset Protection, Medicaid and the following on VA Benefits planning:

- Service Connected Benefits (Veterans & Widows/Dependents)

- Non-Service Connected Benefits – Improved Pension, Housebound, Aid & Attendance

- Asset Eligibility

- Application Process

- Correct Forms

- Annual Reviews

- Appeals Process

- Representation and Marketing – Getting Veterans to March in Your Door

Click here to register and grab one of the few spots remaining.

By Sabrina A. Scott, Paralegal, The Elder & Disability Law Firm of Victoria L. Collier, PC and Production Coordinator for Lawyers for Wartime Veterans, LLC.

Victoria L. Collier, Veteran of the United States Air Force, 1989-1995 and United States Army Reserves, 2001-2004. Victoria is a Certified Elder Law Attorney through the National Elder Law Foundation, Author of 47 Secret Veterans Benefits for Seniors, Author of Paying for Long Term Care: Financial Help for Wartime Veterans: The VA Aid & Attendance Benefit, Founder of The Elder & Disability Law Firm of Victoria L. Collier, PC, Co-Founder of Lawyers for Wartime Veterans, Co-Founder of Veterans Advocate Group of America.