A recent Massachusetts case throws into question whether long-term asset protection is safe. This particular case was disturbing because the defendant in a divorce proceeding's share in an irrevocable trust from his parents was deemed to be a marital asset and had to be distributed to his ex‑wife. This was a third-party trust, created by the parents for the benefit of their son, that had specific spendthrift provisions to prohibit such an attack. The Massachusetts court deemed otherwise.

So is asset protection planning on its way out? Absolutely not, in light of the fact that the case had several significant factors – and as always, the devil is in the details. First, Massachusetts has a very strong statute regarding marital property interests. Second, the trust had a specific termination date wherein the son was going to get the rest, residue and remainder of his share at a specific date. Third, payments from the trust were made regularly and consistently and stopped on the “eve” of the divorce. And fourth, the trustee had ascertainable distribution standards of health, education, maintenance and support. Finally, it had the ideal plaintiff: the wife who shared two special-needs children with the defendant. Put all of that together and judges will find a way to pierce the trust. So what is one to do?

While this case was shocking to many, decisions like this are not a surprise in the Lawyers with Purpose community, which is why we have been recommending certain strategies to safeguard against even the pickiest judges and fact patterns. For example, when traditionally drafting a trust and leaving it to beneficiaries in asset protection trusts, we believe the strongest protection comes from having separate share trusts for each beneficiary, with provisions specific to the needs of the individual beneficiary. Second – and this is the most important part – we believe there should not be ascertainable standards, but rather pure discretionary rights to the trustee. Finally, whenever possible the beneficiary should not be an individual, but rather a class of people. For example, in this case, instead of naming just the son as beneficiary, we would recommend naming the son and his issue as beneficiaries, thereby opening up the class of beneficiaries and enhancing the asset protection. One may be fearful of naming the issue. Well, therein lies the trick. Who is named beneficiary is not ultimately the determining factor of who benefits, but rather who the trustee determines who benefits. Create a class of people the trustee can sprinkle income and/or principal among as they deem appropriate in their absolute discretion (not ascertainable standards).

While this case was shocking to many, decisions like this are not a surprise in the Lawyers with Purpose community, which is why we have been recommending certain strategies to safeguard against even the pickiest judges and fact patterns. For example, when traditionally drafting a trust and leaving it to beneficiaries in asset protection trusts, we believe the strongest protection comes from having separate share trusts for each beneficiary, with provisions specific to the needs of the individual beneficiary. Second – and this is the most important part – we believe there should not be ascertainable standards, but rather pure discretionary rights to the trustee. Finally, whenever possible the beneficiary should not be an individual, but rather a class of people. For example, in this case, instead of naming just the son as beneficiary, we would recommend naming the son and his issue as beneficiaries, thereby opening up the class of beneficiaries and enhancing the asset protection. One may be fearful of naming the issue. Well, therein lies the trick. Who is named beneficiary is not ultimately the determining factor of who benefits, but rather who the trustee determines who benefits. Create a class of people the trustee can sprinkle income and/or principal among as they deem appropriate in their absolute discretion (not ascertainable standards).

In the Massachusetts case, this could have solved the problem. How? During the marriage, it is likely most of the regular payments provided to the son were actually used in the marriage for the children or items that the husband and wife benefited from jointly. By opening up the class of people, the trustee could have made distributions directly to the children to provide support for the children that the husband was using the money for anyway. By doing this, it surely indicates the assets were not assets of the husband's, but were truly a third-party trust that, at the discretion of the trustee, was distributed to various members in the class, thereby not making it a marital asset. The defendant could have continued to use proceeds from the trust for the benefit of his special-needs children even after the divorce; in fact, most fathers would not penalize their children for divorcing from their spouse. But the key distinction would be that the husband would have remained in control of the assets rather than having to surrender them to a former spouse, wherein there would be no control.

The challenge today is that too many lawyers are on autopilot when they're drafting trusts – or worse, their trust drafting software system doesn’t allow the customizations and protections that the Lawyers with Purpose client-centered software does. Our client-centered software advises the attorneys and allows them to custom tailor each and every option. In addition, LWP™ attorneys are trained to think like the worst court you can imagine and identify how to create provisions that are not specifically targeted at a particular goal but rather strategically drafted to accommodate multiple objectives.

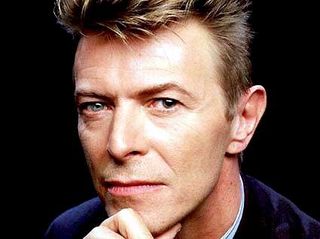

David J. Zumpano, Esq, CPA, Co-founder Lawyers With Purpose, Founder and Senior Partner of Estate Planning Law Center