Many attorneys confuse asset protection with Medicaid planning, and estate tax avoidance. It is essential attorneys and allied professionals are very clear on the key distinctions of asset protection and the types of asset protection that can be obtained.

The first distinction is identifying if protection is desired during life (now), after death, or both? Determining when asset protection is sought, will lead to whether a revocable living trust or irrevocable living trust is utilized. Revocable living trusts typically provide for the management of an individual’s assets during their lifetime if they become incapacitated, and can provide asset protection for those same assets to the beneficiaries, after the grantor’s death. In contrast, a properly drafted irrevocable trust created during lifetime, can provide asset protection when funded, but may not meet the requirements to qualify for benefits eligibility planning, Medicaid, VA and other needs based benefits. A traditional irrevocable trust will provide asset protection as long as the grantor who funds the trust gives up the right to the assets and/or income which protection is desired. Simply restated, if the grantor retains the right to income but not principal, the principal will be protected, but the income will not. General asset protection begins when the asset protection trust is funded. If any liability arose or became known prior to the funding of an irrevocable asset protection trust, the protection will be not be achieved as to those known potential liabilities. Any liability occurring after the funding of the trust, will be protected from any claims related to it.

The first distinction is identifying if protection is desired during life (now), after death, or both? Determining when asset protection is sought, will lead to whether a revocable living trust or irrevocable living trust is utilized. Revocable living trusts typically provide for the management of an individual’s assets during their lifetime if they become incapacitated, and can provide asset protection for those same assets to the beneficiaries, after the grantor’s death. In contrast, a properly drafted irrevocable trust created during lifetime, can provide asset protection when funded, but may not meet the requirements to qualify for benefits eligibility planning, Medicaid, VA and other needs based benefits. A traditional irrevocable trust will provide asset protection as long as the grantor who funds the trust gives up the right to the assets and/or income which protection is desired. Simply restated, if the grantor retains the right to income but not principal, the principal will be protected, but the income will not. General asset protection begins when the asset protection trust is funded. If any liability arose or became known prior to the funding of an irrevocable asset protection trust, the protection will be not be achieved as to those known potential liabilities. Any liability occurring after the funding of the trust, will be protected from any claims related to it.

Unlike asset protection, benefits eligibility planning requires additional restrictions beyond what is required for asset protection. The two most significant distinctions are (1) any rights provided to the spouse of the grantor will be determined available to the grantor or spouse in determining the grantor or spouse’s eligibility for a needs-based benefit; or (2) unlike an asset protection trust where the assets are protected immediately upon funding, funding of an irrevocable asset protection and needs benefits trust exposes the asset to “view” and still be considered in determining the future eligibility of the grantor or spouse for up to five years after the trust is funded. These two additional restrictions are problematic for general asset protection attorneys whose client’s later attempt to qualify for needs-based benefits. A final distinction in needs based benefits planning relates to veteran’s benefits which provide that any asset owned in an asset protection trust that is a grantor trust, is counted (in “view”) in determining eligibility for the Veteran’s Aid and Attendance and Housebound benefits. One caveat however is property held trust which does not generate income and therefore not targeted (or in “view”) by the Veteran’s Administration. Any conversion of the property to income producing will make the proceeds countable in determining the Veteran’s eligibility for benefits, even though it’s in an irrevocable asset protection trust.

Another key distinction with asset protection is whether a “domestic asset protection trust (DAPT)” is utilized or an iPug™. DAPT’s are complicated and available in only 14 states. Typically DAPT’s require a nexus with the state it is created and a close assessment of each of the individual rules associated with the states DAPT statute. In addition, domestic asset protection trusts are typically not successful in being able to plan for needs-based benefits. A more useful approach is the iPug™. The irrevocable pure grantor trust allows the grantor remain as trustee, change the beneficial interest to anyone except themselves, maintain the benefits during their lifetime of income or use of the residence, and to receive a full step up in basis on all trust assets at the grantor’s death.

A final consideration with asset protection is whether any tax reduction strategies are a goal. Some asset protection planning trusts can be utilized to reduce federal estate taxes while others choose to ensure the assets of the asset protection trust are included in the estate of the grantor, to ensure a “step up in basis” on the assets owned by the trust. Other asset protection trusts enable the spreading of income generated by the trust to beneficiaries who are in a lower income tax bracket than the Grantor, thereby minimizing income tax. The choice of trusts available for Estate and income tax planning are various and complex.

So you think you know asset protection, think again. Get clear on your client’s needs and goals and then pursue the trust that best accomplishes them.

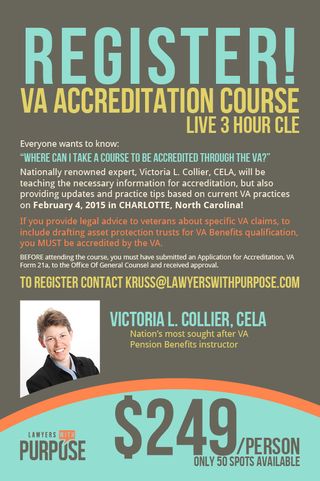

If you want to learn more about understanding how iPug Trusts are used for clients with businesses for asset protection join our FREE webinar this Thursday, February 12th at 8:00 EST. Click here to register now and reserve your spot today.

Here's just some of what you'll discover during the webinar…

- Learn the difference between General Asset Protection, DAPT Protection, Medicaid Protection and iPug® Protection

- Comprehensive outline of the 2 primary iPug® Business Protection Strategies

- Learn why clients choose single purpose Irrevocable Pure Grantor Trusts™ over LLCs

- Learn how it all comes down to Funding

- And much much more… register now to reserve your spot!

David J. Zumpano, Esq, CPA, Co-founder Lawyers With Purpose, Founder and Senior Partner of Estate Planning Law Center