This is the fourth of a four part series on how to represent a claimant before the VA. This article has been updated since it was originally posted on December 23, 2019.

By Matthew Donald, Esq. Director of VA Services

Well the sky didn’t fall but the VA did implement quite a few changes with the rule change in October 2018. It’s just now that we are starting to see the results of the rule changes and how the VA is treating topics changed by the new rule. For example, in every case I have read, anything short of a completed gift trust is being treated as an available resource. Historically, there was a slim chance that a significantly modified grantor trust might slip through. That is not the case now. With that said, there is still plenty of opportunity to assist Veterans and their widow(er)s the VA pension benefit.

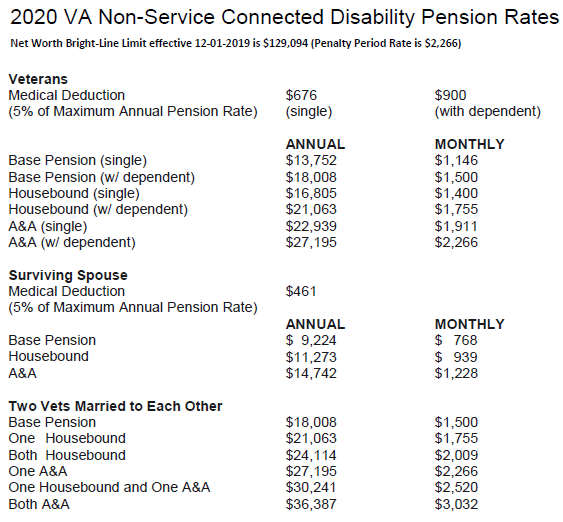

Below is a recap of the most significant changes to the new rule as well as the new “VA numbers”.

Income for VA purposes

- There were some expansions on what is considered an unreimbursed medical expense but overall, the process for calculating the income for VA purposes remains relatively unchanged.

Net worth limit starting December 1, 2019 is $129,094

- Now a bright-line test based upon the maximum community spouse resource allowance under the Medicaid rules. That amount is indexed for inflation based upon the cost of living adjustment for Social Security.

- Net worth includes income for VA purposes based upon an annualized amount. For example, if the income for VA purposes is determined to be $200/month. Then the VA will consider that income to be an asset in the amount of $2,400 ($200 X 12 months). This will count toward the asset limit of $129,094.

Net worth exemptions

- Claimant’s home and “residential lot area” will not be a countable resource. The VA defines “residential lot area” as 2 acres or anything over two acres if the additional acreage is not marketable (i.e. slightly over 2 acres, not accessible, or zoning limitations). Anything in excess of 2 acres is considered a countable resource unless the additional acreage is not marketable. If residence is sold, it becomes a countable resource unless a new residence is purchased within the same calendar year.

- Lump sum insurance payments made as a result of the death of the Veteran are not counted toward net worth or income.

- Federal income tax refunds are excluded from income and assets for one year after receipt.

3 year look back

- Much like Medicaid, the VA has instituted a look back period. For the VA that look back period captures any transfer made during the 36 month period preceding the date of the application.

- Any transfer made during the 36 months preceding the application for less than fair market value will be considered an uncompensated transfer unless the transfer was made prior to October 18, 2018 or the transfer did not cause the claimant to be below the allowable net worth limit.

- Unlike Medicaid, not all uncompensated transfers will result in a penalty period. Only the amount transferred in excess of the net worth limit will be counted when calculating the penalty period. For example, if the claimant made a transfer of $10,000 12 months ago, and the claimant’s net worth before a transfer was $139,094, the $10,000 would considered an uncompensated transfer. By contrast, if the claimant’s net worth before the same transfer was $120,000, the transfer would not result in a penalty period because the transfer is not what caused the claimant to be under the net worth limit.

Penalty period

- Unlike Medicaid, the maximum length of any penalty period for the VA is five (5) years.

- The process for determining the penalty period for the VA is to take the amount of assets determined to be considered as uncompensated and divide that number by the current monthly annual pension rate payable to a Veteran with a dependent ($2,266 as of December 1, 2019). For example, if the applicant transferred $22,660 in excess of the net worth limit, then the penalty period would be 10 months.

- For the VA, the penalty period begins on the first day of the month that follows the last asset transfer which is very different than Medicaid. Using the 10 month penalty period example from above, this means that if the applicant made the transfers on January 1, 2019, the penalty period would begin on February 1, 2019 and end on November 30, 2019 which would mean that the claimant in this example would be eligible for VA pension after November 30, 2019.

Other Notes

- Transfers to annuities (other than mandatory transfers at the time of retirement) and promissory notes are considered uncompensated transfers.

- Life estates were not addressed by the VA at this time.