Lawyers with Purpose is getting ready for some exciting changes in our legal technical training. Over the past several months, as my calendar has been freed up to provide one-on-one legal training and file reviews with members, case-specific questions for the Live Case Study review have slowly faded. As such, we are restructuring the Monday afternoon hour to continue to provide members with the most efficient use of your time and the time of your staff. Moving forward, while we will continue to address all questions that are submitted by 5 p.m. Friday on the following Monday, we will be using a large portion of the legal technical hour as an in-depth study of the Lawyers with Purpose system and the many uses of the LWP Client Centered Software.

Proper Remarriage Protection Planning

Many lawyers proclaim to have remarriage protection in their estate planning documents, but few are worthy of this claim. For most lawyers, having remarriage protection means removing a spouse’s right to benefit from a trust in the event the spouse remarries. Although this is a good start, it is wholly insufficient in determining the expansive abilities that one can have regarding remarriage protections.

So let’s look at the key points. Typically, clients use trusts to benefit their spouse. Outright conveyances to spouses are common, but they do not provide any asset protection or remarriage protection. To ensure that assets are protected in a remarriage, one must plan appropriately in four core areas.

- Beneficial interest of the spouse

- The definition of “remarriage”

- Powers of appointment to the spouse

- Removal powers to the spouse

When designating trusts for clients of long-term marriages, most want to ensure that the intentions of the couple are carried out after the death of the first spouse, and are not adversely influenced. Although this is a common goal, it could be derailed when a new relationship enters the picture after the death of the first spouse. The goals and intentions of the surviving spouse are often altered significantly due to the fear of having lost their spouse and/or the introduction of a new relationship that can influence them. To ensure that the deceased spouse’s intentions are carried out, the Lawyers with Purpose Client-Centered Software (LWP-CCS) ensures remarriage protection at all three levels. Let’s examine each and how they apply to remarriage protection.

When designating trusts for clients of long-term marriages, most want to ensure that the intentions of the couple are carried out after the death of the first spouse, and are not adversely influenced. Although this is a common goal, it could be derailed when a new relationship enters the picture after the death of the first spouse. The goals and intentions of the surviving spouse are often altered significantly due to the fear of having lost their spouse and/or the introduction of a new relationship that can influence them. To ensure that the deceased spouse’s intentions are carried out, the Lawyers with Purpose Client-Centered Software (LWP-CCS) ensures remarriage protection at all three levels. Let’s examine each and how they apply to remarriage protection.

First is the spouse’s right to a beneficial interest. The surviving spouse often has a right to principle and/or income from the deceased spouse’s trust. That interest can come in the form of a family-type trust that benefits the spouse’s kids/non-family, or a common trust with other beneficiaries. So often, we see lawyers name just the spouse as the beneficiary of the family trust. Although this protects the spouse, it also unduly restricts them. A spouse who wants to benefit a child and use assets from the deceased spouse’s trust often has to take the distribution and then give it to the child. Instead, it is more practical to include the children and other descendants as benefits of the principal and income to a surviving spouse. This allows the surviving spouse, as trustee, to distribute or “sprinkle” the income or principal as they determine to accomplish the goals of the family. In contrast, if the surviving spouse gets unduly influenced by a new relationship, then one must be able to restrict that spouse’s right to income and principal under the deceased spouse’s trust. Remember, the surviving spouse has assets that are still available as provided by the original planning.

Another critical issue in remarriage planning is the definition of remarriage. Most trusts define remarriage as however remarriage is legal in the jurisdiction. This is another mistake. In today’s day and age, no one gets married anymore, but not getting married does not mean that a new “significant other” does not have significant influence over the surviving spouse. That’s why Lawyers with Purpose’s Client-Centered Software includes default remarriage language that identifies remarriage as any marriage legal in the jurisdiction or any relationship that results in cohabitation for one night. The software also allows attorneys to custom-tailor the definition of remarriage any way they choose. What’s critically important is what remarriage protections are triggered when the remarriage definition is met, first, upon remarriage under the definition, the ability to access principal or income can be restricted in the LWP-CCS software.

In addition, a deceased spouse’s trust can allow a spouse certain powers of appointment to ensure that the couple’s goals are continued after the death of the first spouse. When there is an outside influence or a remarriage (as defined by you), then you may also begin to restrict the surviving spouse’s power of appointment to ensure that the children are not penalized for failing to agree with the surviving spouse, and the power to make distributions that would go against the deceased spouse’s intentions.

Perhaps the most significant power that can be removed in the LWP-CCS remarriage protection software is the ability to remove a surviving spouse’s removal powers. Removal powers include the surviving spouse’s ability to remove a trustee and/or trust protector of the deceased spouse’s trust. Allowing removal powers after the influence of a new third party can adversely affect children or other beneficiaries who are acting as co-trustees, or trust protectors who were independent and in place to ensure the preservation of the deceased grantor’s intentions. Interestingly, the Lawyers with Purpose software allows not only the appointment of all these powers to a spouse, it also allows you as the attorney to cherry pick which powers, or any combination of them, are altered upon the remarriage of a spouse as you wish to create them with the client.

Again, this is what we call trust drafting. Too many times we have lawyers get comfortable and lazy with the simple provisions most would call “remarriage protection.” That’s why at Lawyers with Purpose our software supports your ability to be purposeful to your client’s plan.

If you want to learn more about what it means to be a Lawyers With Purpose member, consider joining us for THE estate and elder law event not to be missed this June in San Diego. You can see the full agenda here: http://retreat.lawyerswithpurpose.com/agenda/. If you aren't a member contact Molly Hall at mhall@lawyerswithpurpose.com to find out more information about how you can reserve your spot today. Early bird pricing ends Friday, May 13th so register today!

Registration link: www.retreat.lawyerswithpurpose.com

Dave Zumpano, Co-founder – Lawyers With Purpose

The Medicaid Millionaire: Myth or Reality?

As the Lawyers with Purpose attorney trainer, I am often asked by transitioning attorneys or new members how I can justify helping people shelter money so that they could possibly one day receive Medicaid benefits, while still having funds available in trust. I often think as I respond, how could you not?

The Medicaid program was established in 1965. The original purpose of the program was to provide needed care for the indigent. In a 2011 House hearing on “Abuses of Medicaid Eligibility Rules,” Rep. Trey Gowdy argued that the extremely wealthy should not be on Medicaid. Medicaid is a program to alleviate impoverishment, so certainly this argument makes sense. One thing both Donald Trump and Hillary Clinton have in common is that neither should be in our offices asking how to get Medicaid benefits for long-term care.

But Rep. Gowdy went a step further, stating that “Income and asset tests are easy to circumvent and abuse. In fact, a cottage industry has arisen seeking to educate the wealthy on how to transfer or hide assets so taxpayers can pay for their long-term care.” When I read Mr. Gowdy’s quote, certainly I was not shocked. We, as a “cottage industry” of elder care attorneys, have already been pinned “pension poachers” by the Department of Veteran’s Affairs. So, it is not a stretch to hear that we are also being labeled in this way, even though we never break or abuse a law and certainly never ask our clients to do so.

But Rep. Gowdy went a step further, stating that “Income and asset tests are easy to circumvent and abuse. In fact, a cottage industry has arisen seeking to educate the wealthy on how to transfer or hide assets so taxpayers can pay for their long-term care.” When I read Mr. Gowdy’s quote, certainly I was not shocked. We, as a “cottage industry” of elder care attorneys, have already been pinned “pension poachers” by the Department of Veteran’s Affairs. So, it is not a stretch to hear that we are also being labeled in this way, even though we never break or abuse a law and certainly never ask our clients to do so.

I would like to ask Mr. Gowdy, and all of those who paint us with the broad brush stroke of system abusers, if they actually have any idea who our typical clients are. I suspect that they do not. Because the reality is that very few multi-millionaires come into our offices seeking Medicaid benefits. No, they come in for tax planning, they come in for asset protection and they come in for family trust planning. The people who come through our doors because a spouse has just entered the nursing home and they have been asked to deplete their $250,000 in savings to pay $8,000 a month for care are not these “millionaires.” They are the hard-working, tax-paying middle class. And they are frightened, they are nervous and they know that they are quickly becoming the indigent.

Currently, long-term care beneficiaries represent about 7 percent of the Medicaid recipient population. However, they absorb about 19 percent of the Medicaid funds. Why? Because long-term care is astronomically expensive and there is no other public program available to help with the expense. It is also believed that the average pre-plan for couples who plan over five years prior to institutionalization is saving the married client between $240,000 and $750,000. These numbers decrease by over half when we look at crisis cases. When asking why they pre-planned for Medicaid eligibility, below are the answers I received from former clients.

From a former school teacher married to a Vietnam veteran: “My husband has dementia. He could be sick for a long time and I am only 68 years old.”

From a widow with an adult disabled child in her home: “My daughter has special needs and is wheelchair-bound and I need to have the money left over to care for her for the rest of her life.”

From a retired doctor and his wife, a teacher: “I paid taxes all my life and I continue to pay all that is required of me. I also donate time and money to those in need. My children work hard and I do not want to be a burden on them.”

From an auto mechanic with Parkinson’s and his wife, a retired bus driver: “My neighbor lost everything they worked for. I don’t want to die having lost everything I worked for my wife to have when she is alone.”

It is also worth noting that the “Abuses of Medicaid Eligibility Rules” hearing never grew into any proposed law changes. This is most likely because the officials from the state Medicaid agencies and the nursing care industry who were brought in to speak before the committee painted a completely different portrait of the “system abusers.” They told the stories that they see every day. They spoke of the middle class – scared, desperate, and struggling to pay for care – and the attorneys who help them manage the legalities of a complex system. They spoke of the reality, not the myth.

If you haven't registered for the June Tri-Annual Practice Enhancement Retreat we're filling up fast and Early Bird pricing expires soon! Don't miss THE estate and elder law event not to be missed! Click here to register now and reserve your spot!

Kimberly M. Brannon, Esq., Legal Technical & Software Trainer – Lawyers With Purpose

Dig, if you WILL … the truth about Prince’s estate

Doves do not cry. Crying as an expression of pain or emotion is a mammalian trait. I know this to be true because on a 6th grade trip to the zoo, dressed in my finest purple, I asked the zoologist. So I am confident in stating that if you owned a raspberry beret and spent any portion of 1986 walking into the grocery store through the out door, you understand the depths of my mourning for the death of Prince.

As a closet follower of all things pop culture, I have listened repeatedly to my Prince playlist and read every article I have run across about Prince since his death. And then, today, it happened. I read an article so blatantly ridiculous, it could not possibly be true. Who would write such an atrocious, fabricated tale, and who would believe it? Turns out the top celebrity magazine in the country wrote it, and based on the 396 comments I saw, everyone believed it. The article has since been edited. Experts in the area have been interviewed and the magazine has fixed its egregious errors. Most likely these errors were discovered when their own attorneys almost fell out of their chairs, as I did. So, I promise that I will not trouble you with the hideous nature of the original article or the depression that sank further into my soul as I browsed reader comments saying they were going to contact their police stations on the subject. I will simply tell you the title of the article, which will provide you with all of the outrage and confusion you need for the day.

Who Will Get Prince’s Millions? Cops Say They Have No Record of a Will for the Late Singer.

Just let that sink in. As promised I will not regale you with the quotes from the original article saying that if no will is filed soon, the property of the singer who died a few days ago may be divided equally between his siblings. I will not bore you with the notion that the word TRUST was in the original article zero times. I will not tell you how the original article relied on police officers for all quotes related to probate administration. (Of course, they did not use that phrase.)

Just let that sink in. As promised I will not regale you with the quotes from the original article saying that if no will is filed soon, the property of the singer who died a few days ago may be divided equally between his siblings. I will not bore you with the notion that the word TRUST was in the original article zero times. I will not tell you how the original article relied on police officers for all quotes related to probate administration. (Of course, they did not use that phrase.)

I will simply say this: We have no idea what will happen with Prince's estate. However, this article and hundreds of others like it do send a clear message that people are being miseducated and misinformed about estate planning and administration by the media.

As elder care attorneys, we need to take seriously this article and the hundreds of comments from readers believing everything they read. Our baby boomers are reaching the age of health issues, and every family is one accident away from a crisis situation. It is our duty to continue to educate our communities through workshops on the truths about wills, trusts and administration. Understanding the importance of protecting their assets for themselves and their children is a duty LWP attorneys have to our communities, and I am proud that we do not take that lightly.

And, if you are an elder care attorney, I encourage you continue the workshops you provide to your community giving the tools and knowledge necessary to help make educated decisions about family affairs. And, providing options to attendees will potentially save thousands of dollars when crisis strikes or old age rears its ugly head.

Let us, as the LWP community working together with our clients, not give up on our goal of educating and providing the best legal advice out there for families. Let us not give up – until the doves cry.

Early Bird registration and pricing is now open for the June 20th – 24th Tri-Annual Practice Enhancement Retreat in San Diego. During the week you'll discover our most effective and PROVEN practice growth strategies, legal/technical best practices and marketing GOLD – so powerful and cutting edge we will ONLY share them face-to-face! Register today and reserve your seat at early bird pricing!

Kimberly M. Brannon, Esq., Legal-Technical and Software Trainer

The ILIT / TAP Distinction

Many people commonly use Irrevocable Life Insurance Trusts (ILIT) to ensure that life insurance owned by an individual is not included in their taxable estate at death. While an ILIT is a useful trust, you could accomplish far more with a TAP™ trust. So let's review an ILIT and distinguish how a TAP enhances the benefits often sought by ILITs. An ILIT is an irrevocable trust wherein the grantor retains no rights to modify the trust, benefit from the trust or control the trust. Retention of any of these rights will trigger estate tax inclusion under Internal Revenue Code Sections 2036 through 2042. An Irrevocable Life Insurance Trust may be a non-grantor trust or grantor trust, depending upon the attorney's drafting choice.

Triggering a provision of Internal Revenue Code Sections 671 through 679 will cause the inclusion of all income from the ILIT to be included in the personal income tax return of the grantor. While the grantor retains no rights to modify, control, or benefit from the trust, the grantor may be taxed on its income if a grantor trust provision is triggered. The most common of these grantor trust provisions is to allow the grantor to substitute assets of equal value, or make loans to the grantor without adequate security. By choosing grantor trust status, it essentially serves as an additional gift without having to utilize the annual gift tax exclusion, because the income taxes are paid from the grantor, rather than the trust. As a result, those additional sums are retained in the trust, thus providing additional assets to the intended beneficiaries that otherwise would have been used to pay the taxes.

One of the core elements of an ILIT is ensuring the use of Crummey powers. Crummey powers are based on the landmark case Crummey v. the Commissioner wherein the U.S. Tax Court held that granting someone the right to withdraw money funded to a trust immediately but limited to a short period of time (i.e. 30 days) was sufficient timing to deem the contribution a "present interest" and thereby trigger the annual gift tax exclusion for the contribution. A Crummey power is essential to ensure that the annual gift tax exclusions are utilized so as not to reduce the grantor's overall lifetime estate and gift tax exemption. One critical restriction under the current power, however, is that Section of the Internal Revenue Code limits the annual exclusion made to trusts to the greater of 5 percent of trust assets or $5,000. Therefore, it is essential to have a "hanging power" to ensure any contributions in excess of $5,000 or 5 percent are not deemed to be taxable gifts.

One of the core elements of an ILIT is ensuring the use of Crummey powers. Crummey powers are based on the landmark case Crummey v. the Commissioner wherein the U.S. Tax Court held that granting someone the right to withdraw money funded to a trust immediately but limited to a short period of time (i.e. 30 days) was sufficient timing to deem the contribution a "present interest" and thereby trigger the annual gift tax exclusion for the contribution. A Crummey power is essential to ensure that the annual gift tax exclusions are utilized so as not to reduce the grantor's overall lifetime estate and gift tax exemption. One critical restriction under the current power, however, is that Section of the Internal Revenue Code limits the annual exclusion made to trusts to the greater of 5 percent of trust assets or $5,000. Therefore, it is essential to have a "hanging power" to ensure any contributions in excess of $5,000 or 5 percent are not deemed to be taxable gifts.

These hanging powers allow the Crummey beneficiary to continue to have the right to withdraw this excess amount, even beyond the 30-day period. For example, if a grantor contributes $42,000 to a trust for three Crummey beneficiaries and the $42,000 is the only asset of the trust and it was utilized to pay the insurance premium, then 5 percent of the trust assets only equals $2,000. Obviously, $5,000 would be greater, so $5,000 of each $14,000 contribution would be deemed to be a present interest gift and $9,000 of the contribution would "hang" until no contributions are made in a given year. At that time, an additional allocation of the annual gift would occur based on the $5,000 or 5 percent trust value limitation. Obviously, this could be problematic if these powers hang and one of your Crummey beneficiaries becomes subject to lawsuits, divorce or long-term care costs.

Another consideration with the Crummey power is to have straw Crummey beneficiaries. This is typically done by adding beneficiaries to the lifetime trust, which operates during the grantor's lifetime and provides the names of people who are not residuary beneficiaries. For example, one straw Crummey beneficiary might include spouses or other remote relatives who are willing to be a Crummey beneficiary, understanding that they are not likely to be an ultimate beneficiary. This allows additional payments each year to be contributed within the annual exclusion limit. Both ILITs and TAP trusts have Crummey provisions with hanging powers.

Neither ILITs nor TAPs are user friendly to individuals with estates less than $5,450,000, or $10,900,000 if married. These excessive restrictions need not be applied in circumstances where the total estate of the grantor plus the life insurance benefits does not exceed the estate tax limit. Obviously, the only other consideration would be if your state had an estate tax at a lower limit. If estate tax is a concern, a primary benefit of the TAP trust over the ILIT is that a TAP trust stands for Tax All Purpose trust, which means its intended benefit is far beyond the holding of life insurance. The TAP trust will typically hold life insurance policies, stocks, bonds, and other assets and/or business interests that the grantor would like to get passed on to the trust beneficiaries after death. This is especially helpful, as it will ensure that there are other assets in the trust other than the life insurance policy to accumulate assets of more than $280,000 to ensure that the entire Crummey contribution can be utilized each year with no hanging powers. In addition, the TAP trust has extensive provisions for lifetime and residuary trusts to the individuals or classes of people.

For example, sometimes a grantor will create a family-type trust that takes effect after death for the benefit of the surviving spouse and children, and upon the death of the surviving spouse, it provides separate residuary trusts for each child. Other times, clients may want to create a benefit for a class of their children for their lifetime, and at the death of the last child the balance is allocated to their then-surviving children in separate share trusts. TAP trusts are extremely flexible and powerful in ensuring that whatever assets are passed through them (life insurance, stocks, bonds, business interests, etc.) are passed on to their loved ones fully asset-protected in separate asset protection trusts or common trusts, depending on the client's goal. One of the critical distinctions in asset protection trusts after death is to ensure that the trustee is an independent trustee under Internal Revenue Code Section 672(c). One distinction to resolve the concern of naming the child beneficiary as the trustee without violating Section 672(c) is to ensure that you name a co-trustee who is adverse, a strategy far too few lawyers utilize. For example, after the death of a grantor, the surviving spouse can be the trustee with a co-trustee of one of their children. While this would be considered under the family attribution rules to be a controlled trustee, the adverse party interest ensures that the Internal Revenue Code distinctions are met. For example, if a child was a co-trustee with the spouse and approved a payment to the spouse during a family trust administration, that would be adverse to the child's residuary interest and thus satisfy the restrictions within 672(c).

The other exciting element of a TAP trust is the allowance of the spouse or trust protector to have a power of appointment to modify the beneficiaries within a class of people identified by the grantor. This can ensure that the family is able to adjust for changing circumstances after the death of the grantor to cover his or her overall planning intentions. One of the key distinctions of a TAP trust is also specific language that authorizes the accumulation of income but specifically requires the trustee to account separately for income that is accumulated and converted to principal, so as to ensure no portion of that is utilized to pay insurance premiums on the grantor. While the trust ensures that all the proper legal language is included, to be legally proper it is incumbent upon the attorney to educate the client to understand how to properly administer a trust so as not to violate that provision.

So, as you look at the distinctions between an ILIT and a TAP, it's important to note that everything an ILIT is is included in the TAP trust, but not everything in a TAP trust is included in an ILIT, so a TAP is a far more expansive trust that allows much more flexibility and use by a client. If you want to learn more about becoming a Lawyers with Purpose member to discover how the TAP trust can benefit you in your practice and, more importantly, benefit your clients consider joining our FREE webinar "The Four Essentials For A Profitable Practice" on Thursday, April 21st at 8EST. Click here to register now.

This is a FREE training webinar designed for attorneys who wish to add Estate Planning, Asset Protection, Medicaid, or VA Planning to their practice, or significantly improve on their existing business using our PROVEN and paint-by-number strategies. Reserve your spot now!

David J. Zumpano, Co-founder – Lawyers With Purpose, Founder and Senior Partner of Estate Planning Law Center

Advising Trustees of Special Needs Trusts on Spending Issues

Special Needs Trusts are often created with funds received from legal settlements or inheritances. Special Needs Trusts are important documents when established for people who are receiving government benefits. However, as practitioners we must remember that a Special Needs Trust must not only be effectively drafted for those receiving public benefits, the trustee must also make distributions in accordance with the guidelines of the trust so as not to risk loss of Supplemental Security Income (SSI) or Medicaid benefits for the beneficiary.

The first place a trustee should look when making a distribution from an SNT is the four corners of the document. Even though the state code may allow a distribution, if the trust instrument itself does not, the trustee must abide by the language of the trust. For example, most states will allow SNT funds to be used to pay for vacations, but if the trust instrument itself states it is not to be used for “travel expenses,” the trustee is now limited beyond what the state code might allow. However, once the trustee is familiar with the limitations of the trust document, he should look to the state code and what programs the beneficiary is on for any other limitations on disbursement.

Special Needs Trust payments are designed for “supplemental” or luxury needs not provided for by government benefits. SNT funds are not intended to be used for basic shelter or food, as those needs are provided for by the government benefits. Any money from the trust spent on food or shelter on a regular basis, or given directly to the beneficiary, can count as income for government benefit purposes.

Special Needs Trust payments are designed for “supplemental” or luxury needs not provided for by government benefits. SNT funds are not intended to be used for basic shelter or food, as those needs are provided for by the government benefits. Any money from the trust spent on food or shelter on a regular basis, or given directly to the beneficiary, can count as income for government benefit purposes.

If a beneficiary is receiving SSI benefits, the trustee should be cautious not to make payments directly to the beneficiary, payments to restaurants or grocery stores, mortgage or rent payments, or tax payments on the home. Some jurisdictions also frown on disbursements to basic utility companies, stating that those payments are covered by the SSI payment. Most of these types of payments will result in a 1/3 loss of SSI income. So, while they are discouraged disbursements, there may be some cases in which the trustee determines that the benefit of making the payment outweighs the loss of SSI income. For example, if the beneficiary is unable to pay the tax notice on his home, the trustee may decide to pay the taxes and let that money count as income for the beneficiary the month it was paid. In this scenario, the loss of the 1/3 income is far outweighed by keeping the home taxes up to date, assuring that the beneficiary has a place to live.

When institutionalized clients come to us with a Special Needs Trust, we must be cautious with distributions as well. However, there are plenty of supplemental needs the money can pay for. Nursing home patients can use the money in an SNT to pay the additional fee for a private room, a television, eye glasses and tooth care not provided for by Medicaid, the travel expenses and mileage of the sponsor to come and check on the patient, and caregiver expenses. Oftentimes, nursing homes are happy to hear that a patient has a Special Needs Trust to pay for additional expenses that arise, and some homes will look more favorably upon Medicaid and Medicaid-pending patients who have such funds to “supplement” care costs.

The LWPCCS software allows us to create both first-party and third-party Special Needs Trusts that conform with the federal and state requirements and allow the greatest discretion possible to your trustees. It is, of course, important that the trustee understand what distributions he can make and that he contacts an attorney with disbursements he is unsure of. This type of trustee guidance is a great opportunity for us to provide our clients with our understanding and counsel through a maintenance plan.

If you are interested in seeing our estate planning drafting software first hand, just click here and schedule your live complementary demo.

Kimberly M. Brannon, Esq., Legal-Technical and Software Trainer

Congratulations to Debra Robinson, Lawyers With Purpose Member of The Month

Greatest success since joining LWP:

For many years I was in practice with a series of different partners. When I finally broke free and went on my own, I was searching for new and better ways to run my practice. Molly Hall reached out to me at just the right time, and I believed LWP was a perfect fit for my needs. Within a few months, I increased my fees, made a scheduling template and stopped interrupting my work flow to answer client calls, and became a much more efficient practitioner.

My team and I are gearing up to start having workshops. We moved to new offices in January, with a large enough room to hold workshops in-house. We have watched Dave’s videos together several times, and are in the process of editing and printing all the wonderful material made available by LWP. Now all I have to do is learn to tell the jokes.

Impact on my team and my practice:

We are having more frequent staff meetings, I’m sharing more educational material with my team because I realized the more they understand, the more they can take on. We made a list of everything that needed to be done to start having workshops, and everyone pitched in and did even more than I expected

Share something about yourself that most people don’t know about you:

Most people don’t know that my mother was inspirational in how I interact with my elderly clients. My mother met the love of her life when she was 84 and he was 87. They had three wonderful years together before his health failed. They were head over heels in love, and a joy to watch. I learned from them that no matter what your age, life can still bring wonderful surprises if you are open to taking chances.

What is your favorite book and how did it impact your life?

Little Women – I read it as a teenager and it made me want to be a writer like Jo – Maybe someday.

The Death of Ascertainable Standards

The recent Pfannenstiehl v. Pfannenstiehl case in Massachusetts is a pretty good indication that the use of ascertainable standards in asset protection planning is dangerous. While this may be news to you, the Lawyers with Purpose legal community has known this for some time and has changed its recommended planning strategy more than seven years ago on how to ensure asset protection is maintained.

When creating an irrevocable trust, some of the most important legal determinations made are the discretion granted to the trustee to make distributions to the beneficiaries. The two most common are "wholly discretionary" and "ascertainable standards." What is the difference? Traditionally when a trustee is allowed to make distributions pursuant to the health, education, maintenance and support of the beneficiary, that is traditionally identified as ascertainable standards, otherwise known as HEMS.

When creating an irrevocable trust, some of the most important legal determinations made are the discretion granted to the trustee to make distributions to the beneficiaries. The two most common are "wholly discretionary" and "ascertainable standards." What is the difference? Traditionally when a trustee is allowed to make distributions pursuant to the health, education, maintenance and support of the beneficiary, that is traditionally identified as ascertainable standards, otherwise known as HEMS.

This standard was predominantly created through tax law cases where the question became whether the trustee garnered too much control or authority so as to include the assets of the trust in the taxable estate. The court cases resolved that as long as there were ascertainable standards, it would provide sufficient discretion so as not to have the adverse tax impact. So HEMS became the standard of discretion for trustees. Once again, it was a case of the tail wagging the dog. While estate tax planning was a concern in generations past, since 2001 with the passage of EGTRRA and the massive expansion of the estate tax exemption, the HEMS standard for estate tax purposes only applies to less than two out of 1,000 Americans. Why is it, then, that most lawyers still draft their trust for everyone according to the restrictions required for the two-tenths of 1 percent of Americans? The typical answer is, because that's the way they always did it.

At Lawyers with Purpose, we are absolutely present and future-oriented and always looking at the current laws, but more importantly, we consider the relevance of the laws to the needs of the clients. For example, I remember particularly a case where I drafted an irrevocable life insurance trust and granted powers to the spouse that could deem it to be includable in her estate. While this was not the best tax planning strategy for the client, I clearly reviewed all the rules with the client, explained the adverse consequences and the client's response was "I don't care about the tax impacts; I want my wife to have it." In such a case, I had the client sign an acknowledgment that he was made aware of the adverse consequence, but to any third party reviewing the trust, they were confident I committed malpractice. That's the challenge today: Lawyers want to impose their ways on clients. Our job is not to tell clients what to do; our job is to tell clients what they can do, the pros and the cons of each approach, and to let them make the decisions that best suit the needs of their family. Such is true with ascertainable standards.

It is LWP’s recommendation – and has been for many years – wholly discretionary powers are typically worded as that a wholly discretionary standard be used rather than ascertainable standards, “the trustee shall make distributions to any beneficiary in their sole and absolute discretion….” This assures that discretion is held wholly within the trustee and there is less risk of the trust being invaded by outside sources to ensure for the health, education, maintenance and support of the beneficiary. Can you imagine a court looking at a trust that a senior residing in a nursing home was the beneficiary of and the trust provided that that senior was the beneficiary and the trustee can make distributions for health, education, maintenance and support? How can the trustee not deem a distribution for the cost of that nursing home to be for their health or maintenance or support? It's an accident waiting to happen. In fact some states like Ohio have gone as far as to say that any trust that has ascertainable standards can be pierced to make medical payments in accordance with the health, education, maintenance and support provisions. Don't wait. Stop using ascertainable standards now and protect your clients from any undue risk of having their asset protection trust invaded.

If you would like to learn more about our estate planning drafting software and how it can support you in your estate or elder law practice, schedule a live software demo at: https://www.lawyerswithpurpose.com/Estate-Planning-Drafting-Software.php. Learn how you can (1) regain lost hours (2) train your team so you spend less time drafting (3) effective document prep for 99% of your estate planning clients (4) and much, much more….

David J. Zumpano, Co-founder – Lawyers With Purpose, Founder and Senior Partner of Estate Planning Law Center

Utilizing the New LWP-CCS Personal Services Agreement

Personal service agreements, or personal care agreements, are typically agreements between a family member providing care and another needing care. These agreements act as a legal contract between the two parties regarding the range of care one party is providing to the other. As a Medicaid and/or VA planning tool, a personal service agreements may act as a method of spend-down while making sure your elderly client is provided the services needed and is appropriately compensating a family member who is making personal and professional sacrifices to provide the services.

We are excited to share that the LWP Client-Centered Software is now providing a comprehensive Personal Services Agreement that thoroughly addresses the many issues that Medicaid will consider when analyzing a care plan. The care plan also offers the language you will need if a client starts receiving VA benefits and plans to pay those to a child or family member to provide care.

First, the software incorporates all parties involved in the plan and requires that all parties sign the plan.

First, the software incorporates all parties involved in the plan and requires that all parties sign the plan.

Medicaid wants to make sure that the compensation offered to the caregiver is reasonable in the area of the country where the services are provided. The LWPCCS incorporates the hourly rates of court-appointed guardians, geriatric-care professionals and general-service providers to justify the hourly rate paid to the caregiver. If you opt to do so, the software can calculate the hourly rate of the caregiver as the average of the rates provided for the professionals mentioned above.

Medicaid will want to know where the care is provided. This can be especially important if the child is moving in with the parent to provide care in lieu of nursing care, as they may later qualify for the child caregiver exemption. The software assumes the care is at the home of the person needing care. However, with the click of a button you can choose another place of care, be it in the child’s home, an assisted living facility, an independent living facility or a nursing home.

The terms of the agreement are an important part of creating a valid contract and meeting Medicaid requirements. The LWPCCS allows you to determine the start date of the agreement, the term of the agreement (lifetime, term of years or term of weeks), how often the caregiver will be paid, and the hourly rate the caregiver receives. Another important note: When the caregiver agreement is produced, it defines the caregiver’s role as that of a general contractor and eliminates any tax liability for the person receiving care, providing additional protections for your client.

The feature of the software that allows you to specify which activities of daily living (ADLs) the person needs assistance with can help with Medicaid guidelines and VA guidelines as well.

Finally, alternate caregivers are named for any time periods during which the caregiver is unable to perform the tasks, due to personal illness, vacation, other employment or any other reason.

You can find the new personal services agreement in the LWPCCS under the Medicaid Qualification folder, since we see it as a critical part of Medicaid planning. Incorporating the new LWP Personal Care Agreement into your practice is yet another layer of solid legal planning and documentation we provide for our clients as LWP attorneys.

If you want to learn more about adding medicaid to your estate or elder law practice register for our FREE WEBINAR "Simplifying Medicaid Eligibility & Qualified Transfers" on Tuesday, March 15th at 2 EST. Click here to reserve your spot now.

Here's just some of what you'll discover…

- Understanding the 12 Key terms of Medicaid

- Learn the Qualification Standards: Does Client Meet Needs Tests?

- Learn the Medicaid Terms of Art

- Learn the Snap Shot, Look Back/Look Forward Distinction: And how to put it all together

- At the end of the event receive an ALL STATES Medicaid Planning Resource Guide

- …and much, much more!

Just register here to reserve your seat… it's 100% FREE!

Kimberly M. Brannon, Esq., Legal-Technical & Software Trainer, Lawyers With Purpose

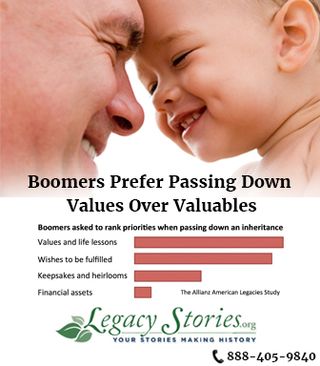

Values vs. Valuables

A recent survey conducted by the Allianz Academy of Legacies asked Baby Boomers and their parents to rank priorities when leaving an inheritance.

Overwhelmingly, they preferred passing down their “values” vs. “valuables.”

Yet, only a small fraction of these generations has made provisions for this in their estate plans, mainly due to a lack of professional guidance and a practical legacy plan.

As such, the demand for providing a values solution is expected to increase dramatically in the coming years, and estate planners are in the most advantageous position to benefit.

As such, the demand for providing a values solution is expected to increase dramatically in the coming years, and estate planners are in the most advantageous position to benefit.

Not only do families find it difficult to get professional advice on this matter, but also the professionals they consult with have few options to offer – until now.

Over the past decade, the team at Legacy Stories has provided senior care professionals with a life review program that has become an industry standard. Now the methods and technology have been reformatted to serve the estate planning and financial advisor community.

To that end, the “Legacy Values Plan” is designed specifically to be a comprehensive self-guided legacy-building solution that can attract new clients and increase client retention with no added staff or training.

This award-winning solution helps your clients preserve and pass down their life lessons, values and experiences as an essential part of today’s estate plan.

Lawyers with Purpose has made arrangements to offer its members this exceptional program at 20% off.

To learn more go to: https://www.legacystories.org/values

Apply this code for the discount: LWP20

Tom Cormier, Co-founder, LegacyStories.org

Roslyn Drotar, Online Marketing, Content & Social Strategist for Lawyers With Purpose