One of my favorite sayings is, “you need to feel to heal.” As estate planning & elder law attorneys, you know all too intimately about the need for healing, especially after losing a loved one. The past few weeks on Facebook (Facebook = gospel, right?) I have been stumbling across articles on grief, usually some version of 3, 5, 10 things you must avoid saying or doing when “dealing” with someone going through the grieving process. A few of the articles contained some great tips, others not so good and some just downright offensive. The topic got me thinking about how the grieving process provides a wonderful opportunity for estate and elder law attorneys to authentically and compassionately stand out from other attorneys in their marketplace, simply by connecting in an impactful way with their grieving clients - especially when the pasta salad stops rolling in.

June of this year I suddenly lost my father, three weeks after I got the dreaded phone call, “you need to hop on a plane.” I grew up in a close-knit Irish catholic family, one of six children, so naturally this was an enormous upheaval to our family. This has been one of the hardest things I have ever had to cope with. It’s been five months, and in many ways today is much harder than June 5th, the day hospice wheeled my father out of our family home of 42 years. What I took away from the article was not only what not to say when supporting someone who is grieving, but it got me thinking about how to turn what not to do into a beautiful opportunity of what TO do.

Sitting here now, when all the multiple sandwich platters, planters, bouquets of beautiful flowers and sympathy cards have stopped, is when I feel that an unexpected reach-out would be so very comforting.

The best piece of advice I took away from the many articles I stumbled upon is this: Don’t say “Anything I can do, please shout/call” or similar. The article suggested you offer to do something, anything. Real, tangible things. “I will drop by around 6 p.m. with a few things from the market, I’m doing this regardless, so is there anything specific you would like from the supermarket?” An elusive question like “what can I help with” is not nearly as impactful as an actual do. When you’re grieving, you learn to hear “anything I can do, please call” as “I have no idea what to say and have no intention of doing anything.” Don’t put yourself in that bracket.

When you lose someone, it takes a long time to fully process all the little things in your life the departed took with them. You are in absolute shock and feel as if you are walking around in a total fog. For me it was at least 60 days of that. Experiencing small gestures without having to initiate really helps the grieving feel like you really, truly care, not only about “what they are going through” but “how they get through it” just as much. Confusion from significant perspective change will nearly always prevent someone who is grieving from really knowing what they want to the point of being able to take the initiative of asking.

Either way, it must feel sincere for them to understand you REALLY mean it.

During the first month of someone grieving, there are so many cards and gestures. All very healing, but nonetheless, there are many and all at once. I am finally moving from the denial phase to the grief phase of the grieving process, after more than five months of feeling absolute exhaustion. I would be immensely grateful for an unexpected meal, an offer to take the kids for a few hours, a heartfelt card in the mail at the end of a long day or an offer for coffee to reconnect. From my personal experience, many months after the passing of a loved one, a small gesture would make such an extraordinary impact. Take the opening when someone you care for finds themselves grieving; clients, friends, neighbors, referral sources and family alike. Simply schedule in your calendar, just like you would a dentist appointment, maybe one, two or three reminders over that first year to check in and do something to let them know you are not only thinking of them but are personally attentive to their healing. Drop off a meal, send a card, or offer a lunch date; whatever feels authentic and meaningful for you.

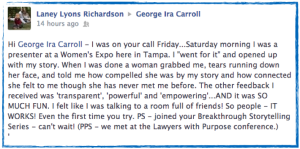

Looking back on how I have supported folks in my life through difficult times, I wish I had this invaluable guidance. And in supporting many professionals in this arena of estate planning, I see such an incredible opportunity to make a difference in their client services. As long as whatever you do comes from a place of authentic compassion, you will ultimately stand out from the masses. And knowing you have something so significant in your arsenal fills that helpless feeling of “How can I help” when you initially receive the news, and sending flowers doesn’t really feel like quite enough.

Molly L. Hall, Co-Founder, Lawyers with Purpose, LLC, and author of Don’t Be a Yes Chick: How to Stop Babysitting Your Boss, Transform Your Job and Work with a Dream Team Without Losing Your Sanity or Your Spirit in the Process.